GST Registration

GST, or Goods and Services Tax, is an indirect tax that replaced multiple other indirect taxes, including excise duty, VAT, and service tax. It applies to the supply of goods and services and follows a comprehensive, multi-stage, destination-based structure. By merging various indirect taxes, GST creates a unified domestic tax system.

GST Types Every Taxpayer Must Know

CGST (Central GST

Collected by the central government on intra-state sales for national projects and services.

SGST (State GST)

Collected by state governments on intra-state sales to fund local initiatives.

IGST (Integrated GST)

Applied to inter-state transactions, ensuring fair revenue distribution.

UTGST (Union Territory GST)

Levied on sales within Union Territories for regional development.

Who Needs to Register for GST?

GST Registration Process (Step-by-Step)

Visit the GST Portal

Fill Part A

Receive TRN

Fill Part B

Submit Application

ARN Generation

Verification & Approval

Receive GSTIN

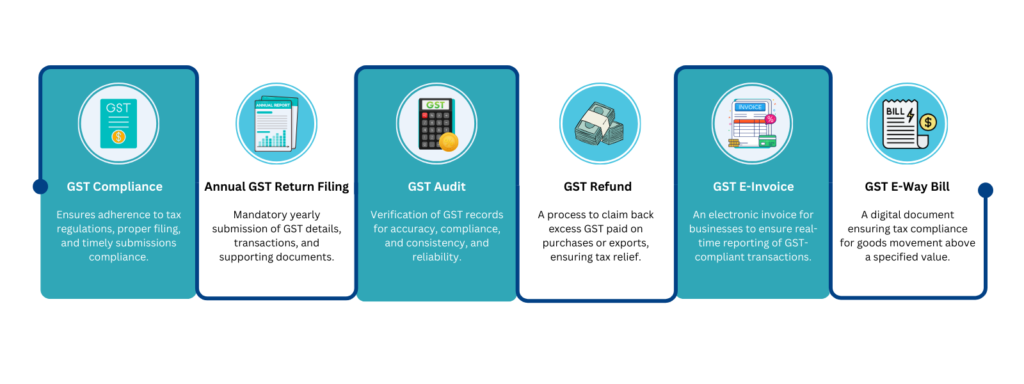

GST Compliance and (Filing Essentials)

Income Tax

Income tax is a direct tax levied on the earnings of individuals and businesses, playing a crucial role in government revenue. It includes Tax Deducted at Source (TDS), where tax is deducted at the time of income payment to ensure timely collection. Additionally, taxpayers must file an Income Tax Return (ITR) to report their income, claim deductions, and settle tax liabilities. Proper compliance with income tax regulations, including TDS deductions and ITR filing, ensures financial transparency and helps avoid penalties.

Income Tax Essentials

Income Tax Return (ITR)

Income Tax Return (ITR) is a form submitted to the tax authorities that reports an individual or business's income, expenses, and taxes paid during a financial year. Filing ITR ensures compliance with tax regulations, helps in claiming refunds, and serves as proof of income for various purposes like loans or visa applications.

TDS (Tax Deducted at Source)

TDS (Tax Deducted at Source) is a method of collecting income tax in which the payer deducts tax from the payment made to the payee before transferring the balance amount. This system ensures that taxes are collected at the time of income generation, making tax compliance more efficient and reducing the risk of tax evasion.

Who can file ITR / TDS?

Anyone earning above the taxable income limit is required to file an Income Tax Return (ITR). This includes:

- Individuals earning a salary, business income, or any other source of income.

- Companies and Firms must file ITR to report their financials.

- Freelancers and Professionals whose income exceeds the exemption limit.

- Non-Residents who earn income in the country.

HUF (Hindu Undivided Family), if applicable under the tax regulations.

TDS must be deducted and filed by the following entities:

- Employers: They are responsible for deducting TDS on employee salaries and remitting it to the government.

- Banks and Financial Institutions: They deduct TDS on interest income earned by individuals and companies.

- Business Owners/Companies: Businesses must deduct TDS on payments made to contractors, professionals, rent, etc.

- Government Bodies: Government departments and public sector units deduct TDS on various payments like salary, interest, and services.

- Other Entities: Any person or entity making payments subject to TDS, including for services, commissions, and dividends, is obligated to deduct and file TDS returns.

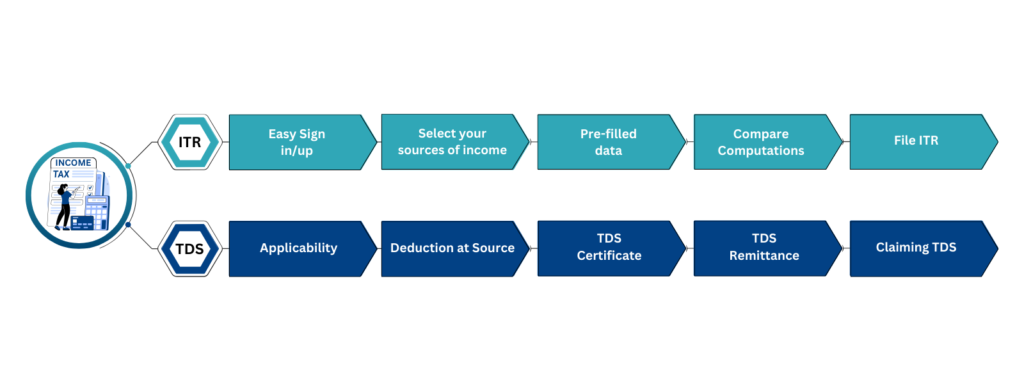

Steps to File ITR / TDS

ROC

ROC (Registrar of Companies) Compliance refers to the mandatory filing and reporting requirements that businesses must fulfill under the Companies Act, 2013. Failure to comply can lead to penalties, fines, or even company strike-off by the ROC.

Our ROC Services

Company Incorporation

Annual Compliance Filings

ROC Event-Based Filings

Company Closure & Strike-Off

Name Change & Capital Alteration

Additional Corporate Services by AccorpMed

Secretarial Services

Drafting board resolutions, meeting minutes, and shareholder agreements.

Business Licensing & Approvals

✔ Follow the Arm’s Length Pricing methods prescribedHelping businesses obtain industry-specific licenses and government approvals. by CBDT

Corporate Governance Advisory

Assisting in structuring corporate policies and internal compliance frameworks.

Merger & Acquisition Support

Guiding businesses through mergers, acquisitions, and corporate restructuring.

Transfer Pricing

Transfer Pricing refers to the pricing of transactions between associated enterprises that are part of the same multinational group. These transactions may include goods, services, intellectual property, loans, or other financial arrangements.

To prevent tax evasion, the Income Tax Act, 1961 (Section 92-92F) mandates that such transactions comply with the Arm’s Length Principle (ALP)—meaning prices should be similar to those in transactions between independent entities.

Transfer Pricing Process

Assessment & Planning

Documentation

Benchmarking Analysis

Compliance & APA Support

Safe Harbour & Dispute Resolution

Monitoring & Optimization

How to Stay Compliant?

✔ Maintain detailed documentation of international transactions

✔ Follow the Arm’s Length Pricing methods prescribed by CBDT

✔ File Transfer Pricing Forms (3CEB, 3CEAA, 3CEAD) on time

✔ Consult a Transfer Pricing Expert or Chartered Accountant (CA)

Company Registration

AccorpMed simplifies company registration across India, Dubai, UK, and the USA, ensuring seamless legal compliance. We assist with structuring businesses, handling documentation, and meeting regulatory requirements. Whether registering a Pvt Ltd in India, a Free Zone company in Dubai, an Ltd in the UK, or an LLC in the USA, we provide expert guidance for a smooth setup. Our services ensure hassle-free registration, tax compliance, and adherence to local laws, helping businesses establish and grow confidently.

Our Company Registration Service

India

We assist in registering businesses under the Ministry of Corporate Affairs (MCA), including Private Limited Company (Pvt Ltd), Limited Liability Partnership (LLP), and One Person Company (OPC). Our experts handle documentation, GST registration, PAN/TAN, and ROC filings to ensure full compliance.

Dubai

Whether you choose a Mainland, Free Zone, or Offshore company, we guide you through Dubai’s business setup process, helping you obtain trade licenses, investor visas, and tax advantages. Our services ensure 100% foreign ownership in Free Zones and smooth business incorporation.

UK

We streamline company registration with Companies House, primarily for Limited Companies (Ltd). Our services include business structuring, tax registration under HMRC, and compliance management, ensuring businesses operate legally and efficiently in the UK market.

USA

Registering a business in the USA requires compliance with state-level laws. We assist in forming LLCs, C-Corps, and S-Corps, handling IRS taxation, EIN registration, and state filings. Whether you're a local entrepreneur or an international business expanding to the US, we ensure a seamless process.

Post-Registration Support & Compliance

Tax Compliance

Assistance with GST, VAT, corporate tax, and annual filings.

Licensing & Permits

Ensuring your business meets industry-specific regulations.

Accounting & Payroll

Helping with financial reporting and employee payroll management.

Bank Account Setup

Assistance in opening business bank accounts for seamless transactions.

Contact Information

support@accorpmed.com

+91 99682 97717

909, ITL Twin Tower, B-9, Netaji Subhash Place, Pitampura, Delhi-110034 (INDIA)

2025-26 © accorpmed.com | All Rights Reserved